Key Points

- If you work full-time (30+ hours/week) for a qualifying public service employer, make 120 eligible payments on a Direct Loan under a qualifying repayment plan and the remainder of your balance can be forgiven under PSLF.

- Some loan types and repayment plans are not eligible.

- Make sure to certify your employment and track your progress.

Public Service Loan Forgiveness (PSLF) is the best student loan forgiveness program currently available.

Just a couple years ago, the first round of public servants became eligible for Public Service Loan Forgiveness. These early recipients were the first to have their Direct student loans forgiven with the PSLF program.

With growing awareness of the program, and an increased number of income-driven repayment plans, more and more people are becoming eligible for loan forgiveness. Are you a person who could become eligible for loan forgiveness? Find out in our ultimate guide to Public Service student loan forgiveness.

Would you like to save this?

What Is Public Service Loan Forgiveness?

Public Service Loan Forgiveness (PSLF) is a federal program that allows loan forgiveness for qualified employees who work full-time for a variety of employers. Full-time work requires working at least 30 hours per week.

After 120 on-time payments (10 years) of federal student loans (more on that below), qualified applicants will have the remainder of their federal loans forgiven.

Qualified employers of public service jobs include:

- The government (including military, law enforcement, schools. and universities)

- Tax-exempt not-for-profit 501(c)(3) companies; including tax-exempt hospitals, tax-exempt charitable organizations, tax-exempt educational institutions, etc. (It’s important to note that if you’re a member of clergy or your work is religious in nature, you may not receive exemption. To qualify you must spend at least 30 hours per week on work that doesn’t have to do with proselytizing, conducting worship services, or providing religious instruction.)

- Peace Corps or AmeriCorps

- Other non-profit organizations that provide one of the following services:

- Emergency management

- Military service

- Public safety

- Law enforcement

- Public interest law services

- Early childhood education (including licensed or regulated healthcare, Head Start, and state-funded prekindergarten)

- Public service for individuals with disabilities and the elderly

- Public health (including nurses, nurse practitioners, nurses in a clinical setting, and full-time professionals engaged in healthcare practitioner occupations and healthcare support occupations, as such terms are defined by the Bureau of Labor Statistics)

- Public education

- Public library services

- School library or other school-based services

Advocacy groups, political groups, and labor unions are not qualified employers.

How Does the 120-Payment System Work?

To actually get loan forgiveness, you have to make 120 “qualified” payments on your student loans. Qualified payments have to meet the following criteria:

- You were employed full-time by a qualified employer

- Your loans were not in deferment, forbearance, or default

- The payment was made after October 1, 2007

- Made on time and in full (paid the full installment amount – not just what your bill says – within 15 days of the due date). As of August 2020, prepayments are allowed, but you can see our full article on Pay Ahead Status and PSLF and why we still caution against this.

- Under a qualified repayment plan (One of the most important things to understand is the requirement of being under a qualified repayment plan. Qualified repayment plans include any income-driven repayment plans – IBR, PAYE, REPAYE/SAVE, ICR. These include monthly payments of $0 that might accrue if you’re earning a wage below the poverty line. Payments made under the Standard Repayment Plan for Direct Consolidation Loans would qualify for PSLF purposes only if the maximum repayment period was set at 10 years. If you have Direct Consolidation Loans, be sure to combine the loan with an income-driven repayment plan.)

The 120 payments don’t have to be consecutive. So if you take a few years off of public service work, you can come back in where you started.

If you do make a large lump-sum prepayment, that payment will potentially count as qualifying payments (given employment certification is on file and all other eligibility conditions are met) under the PSLF Program for up to 12 months or until the next time their income-driven repayment plan is due for certification, whichever comes first. We still don’t advise this, but it does help with the pay-ahead status issue. See the announcement here.

Typically, if you consolidate your loans, the clock on the 120 payments restarts. That’s right. The clock on the 120 payments resets when you consolidate your student loans. The best time to consolidate your student loans is at the beginning of the loan forgiveness process. The second best time is never.

Some tips for making the most out of PSLF:

- Don’t make larger payments than are necessary.

- Don’t make more than one payment per month.

- Get on an income-driven repayment plan right away.

- If you want to consolidate your loans, do so as soon as you graduate from college.

When Does the Clock Start for My 120 Loan Payments?

You can begin making qualifying PSLF payments once the in-school deferment and grace period on your loans ends. If you want to start making payments right away, consolidate your loans and begin repayment immediately.

Warning: Consolidating loans can “reset the clock” on PSLF! Remember, consolidating your federal loans can reset “some” of the clock on Public Service Loan Forgiveness. You might now want to consolidate your student loans if you’re going for PSLF.

What’s New In 2025? Instead of fulling reseting the clock, consolidating your student loans now simply makes your new loan have a weighted average of qualifying payment counts. Learn more about the PSLF Weighted Average Rule.

How Do I Apply for Public Service Loan Forgiveness?

The best way to apply for Public Service Loan Forgiveness today is to use the PSLF Help Tool. This online application will help you fill out everything you need and ensure that you don’t miss anything. However, when you’re done with the tool, it will simply make you print the PDF PSLF Form. You must take this form to your employer for signature and then submit by mail, fax, or secure upload to your loan servicer’s website.

You’ll want to complete and submit the Application and Employment Certification form for Public Service Loan Forgiveness annually or when you change employers.

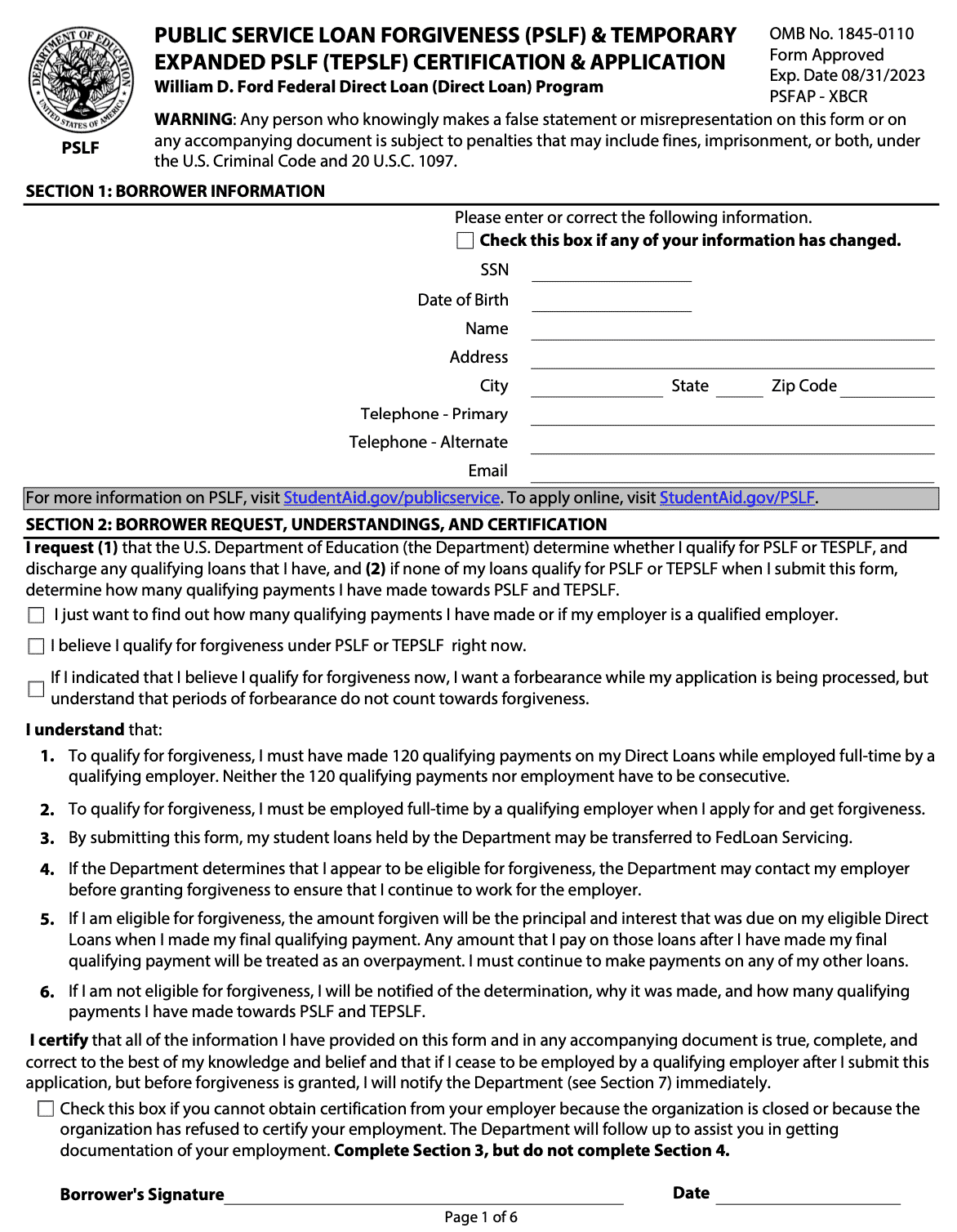

How To Fill Out The PSLF Form

Filling out the PSLF form is easy – it’s basically like a job application. On Page 1 you simply fill out your personal information (name, SSN, date of birth, address, etc.). You also check the box for the reason you’re filling out the form.

You have three choices:

- I want to find out how many qualifying payments I have

- I believe I qualify for loan forgiveness under PSLF or TEPSLF right now

- If I believe I qualify right now, I want a forbearance while my application is being processed

If you know you’re not at 120 payments yet, simply check box 1 to certify your employment.

If you’re at 120 payments, you can select box 2 (and 3 if you desire). Three is risky if you’re close or unsure. However, if you’re beyond 120 payments, you will get a refund for any excess payments once your application is processed.

PSLF Form Page 1. Source: Department of Education

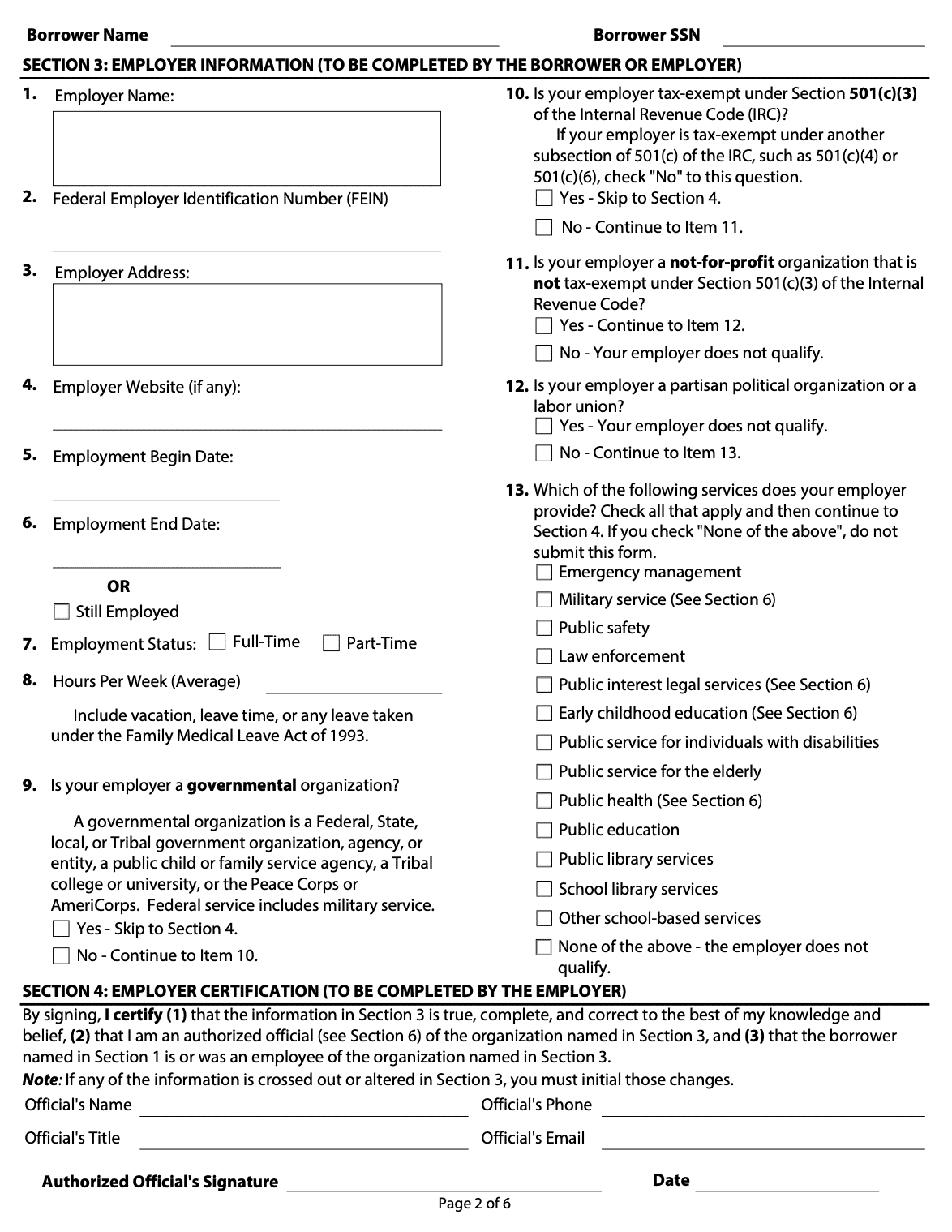

Page 2 of the PSLF Form simply asks for all your employer information. Employer name, address, Federal Identification Number (you can find this on your W2), website, and employment dates. You also select what type of employer this is.

At the bottom of the form, you need your employer to fill it out. This could be your boss, the owner, or HR.

PSLF Form Page 2. Source: Department of Education

After You Complete The Form

After you complete the form, you can either print the form and get a wet ink signature from your employer, OR if you are using the PSLF Help Tool, you can enter your employer’s email address and they will send the form for an electronic signature.

Once you get the formed filled out, submit the form to your loan servier.

What’s new in 2025? MOHELA used to be the only PSLF-eligible loan servicer. However, now any loan servicer can handle PSLF and so you don’t need to worry about moving to MOHELA.

Which Loans Are Eligible for PSLF?

Private student loans are not eligible for loan forgiveness. PSLF is only a program for student loans of the Federal Direct Loans type. These include:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Direct Consolidation Loans (Editor’s Note: See the warning about this as previously written in this article.)

If the loan isn’t on the list above, it’s not eligible for loan forgiveness.

Important Note Regarding FFEL and Perkins Loans: President Biden announced that there will be a limited waiver for prior payments that were made under FFEL or Perkins Loans. This waiver has now expired. Learn more here.

Are Direct Consolidation Loans Really Eligible?

Direct Consolidation Loans are eligible for loan forgiveness, but with several important caveats.

First, if you and your spouse consolidated onto a Direct Consolidation Loan, and only one of you met the employment requirements, the portion of the balance attributable to the qualified employee is forgiven. The rest is not.

Additionally, joint consolidation loans from the Federal Family Education Loan (FFEL) Program cannot be forgiven. Learn more about what to do with joint spousal consolidation loans here.

Finally, any time you consolidate your federal loans, you restart the 120-payment requirement.

Are FFEL Loans Forgivable?

Typically, no. But President Biden announced a waiver that past payments that were made under FFEL or Perkins Loans will count for PSLF. However, to qualify, you must consolidate your loan into a new Direct student loan AND have employment certifications on file for those past payments. Learn more here.

Up until June 2010, Federal Family Education Loan (FFEL) Program loans were one of the biggest federal loans issued to student borrowers. Unfortunately, these loans were not issued by the U.S. Department of Education, and do not qualify for PSLF.

You could consolidate these loans into a Direct Consolidation Loan, but that will reset the clock on your PSLF.

Note: If you consolidate your FFEL loan prior to October 31, 2022, you can apply for PSLF and eligible payments will count.

Is Loan Forgiveness Taxable?

One of the best perks of PSLF is that the loan forgiveness is not taxable. No matter how much interest you’ve accrued, the full balance of the loan is forgiven, and the amount forgiven isn’t taxed.

However, some states may levy a tax on forgiven student loans (specifically Mississippi). See this guide: State Taxes and Student Loan Forgiveness.

What Happens to PSLF If I Default on My Loans?

If you’re on an income-driven repayment plan, you should never default on your loans. Paying your student loans should be one of your highest financial priorities.

That said, any debt in default is not counted as a qualifying payment on your loan. That includes any time you spend “rehabbing” the loan to current status.

Keep your student loans out of default by prioritizing repayment. Remember, if your income adjusts downward (say you lose your job), you can reset your repayment plan in the middle of the year.

Will Public Service Loan Forgiveness Still Be Around?

PSLF is one of the favorite punching bags for Congress. An act of Congress could eliminate the program today. That said, it’s more likely that the rules for qualified employment will be narrowed rather than the program being completely eliminated.

If you’re very worried about it, you may want to continue making the standard payments on your student loans. Just remember, all of the potential changes are just proposals. Check out the full list of Trump Student Loan Forgiveness Proposals here.

How To Appeal Your PSLF Payment Count

Over the last few years, borrowers have complained that their PSLF qualifying payment count has not been accurate – specifically missing payments. If you’re missing payments, there are two things you should know about appealing your PSLF payment count.

If you believe there is an error, you can manually appeal your PSLF payment count. Here’s how:

- Borrowers can visit the PSLF Reconsideration Request Form to submit a reconsideration request.

- Borrowers will login with their FSA ID.

- You will then have to choose between an employer or a payment reconsideration request and describe in as much detail as possible why your PSLF eligibility status should be reconsidered.

- Upload supporting documentation, such as proof of payments and proof of qualifying employment, as well as any correspondence from FedLoan Servicing.

Temporary Expanded PSLF (TEPSLF)

In 2018, Congress created Temporary Expanded Public Service Loan Forgiveness. This program is designed to help borrowers who were on the wrong repayment plan, but otherwise would have been eligible to have their loans forgiven under PSLF.

This is a complicated exception to the program, and it only applies to certain borrowers on the wrong repayment plan (not wrong loan type of disqualified employment).

We break down the full requirements and how it works here: Temporary Expended PSLF (TEPSLF)

FAQ

What qualifies as a “public service employer” for PSLF?

An employer such as the U.S. federal government, state/local government, a 501(c)(3) nonprofit, AmeriCorps/Peace Corps, or other organization providing specific public services (education, public safety, healthcare, library services).

What types of loans are eligible for PSLF?

Only federal Direct Loans (Direct Subsidized, Direct Unsubsidized, Direct PLUS, Direct Consolidation) are eligible. Older FFEL or Perkins loans are not eligible unless consolidated into a Direct Loan.

Do I have to make 120 consecutive payments for PSLF?

No. The payments do not have to be consecutive – you can switch employment or go into forbearance (though payments made in deferment/forbearance typically won’t count).

Will the forgiven amount under PSLF be taxed?

Forgiveness under PSLF is not taxable for federal income tax. Some states may still tax it, so check your state’s rules.

What should I do if my payment count for PSLF seems wrong or is missing payments?

You can submit a “Reconsideration Request” form (for either employer or payment concerns) via your FSA ID account and upload supporting documentation (payments, W-2s, employer certification).

Final Thoughts

PSLF is a great program, but it does require you follow very strict rules to get your loans forgiven.

If you’re unsure about what to do or how to fill out the certification forms, check out Chipper and see if it can help you better track your PSLF eligibility.

Editor’s Note: This article has been updated to reflect loan servicer changes, date changes, and other updated information in 2025.

The post How To Qualify For Public Service Loan Forgiveness [Guide] appeared first on The College Investor.