E-file.com is a tax filing software program that offers intuitive guidance and a clutter-free interface designed to help users file their taxes quickly. However, it’s not easy to report your investment-related activity. While they offer free, limited federal filing, E-file.com is overpriced at every level, particularly compared to higher-quality free options and more robust paid alternatives.

For these reasons, we recommend avoiding E-file.com in 2026. If you’re considering using E-file.com to file your 2025 income taxes (filed in 2026), read the following review first. Or, check out how they compare to other leading online tax prep companies here: Best Tax Software 2026.

E-file.com – Is It Free?

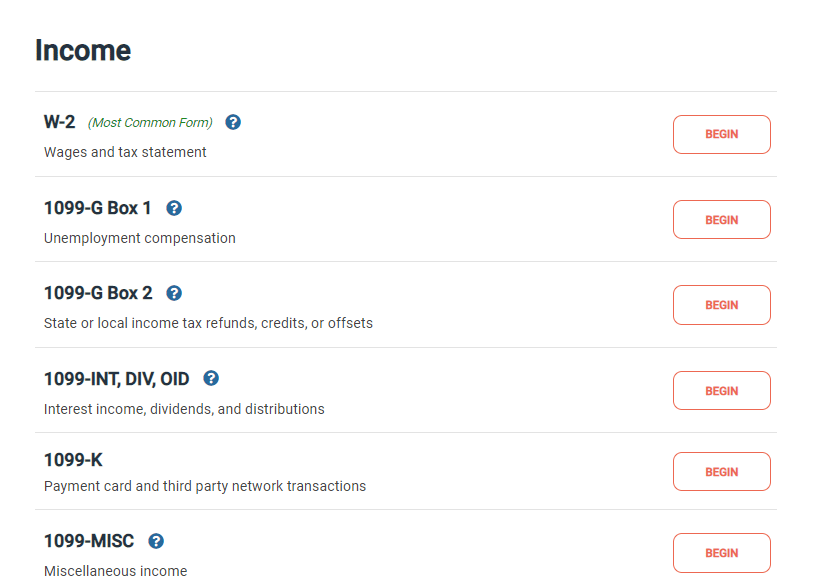

E-File.com offers a restrictive free federal filing option, but all users must pay for state filing. The “Free” option only includes W-2 income and the Rebate Recovery Credit. If you live in a state that doesn’t require a tax return and have extremely simple taxes, you can file for free. But that’s very rare.

All other credits and deductions (including the Child Tax Credit and HSA contributions) require you to upgrade to a paid product. Because an overwhelming majority of people won’t qualify for free filing with E-file.com, it’s best to think of it as a paid product.

What’s New In 2026?

Note: E-file.com made updates for The One Big Beautiful Bill Act and other tax law changes.

E-file.com has made the required updates to handle the new limits for tax credits and deductions for the 2025 tax year (filing in 2026). Otherwise, it’s mostly unchanged from prior years. Due to IRS adjustments, expect new standard deduction limits, brackets, and other changes throughout your tax return.

The navigation menus and form styles have improved over the years, making E-file.com an easy-to-navigate tax app. Users with simple tax returns will likely be able to file their taxes quickly, though investors and others with more complex needs will have to deal with tedious data entry.

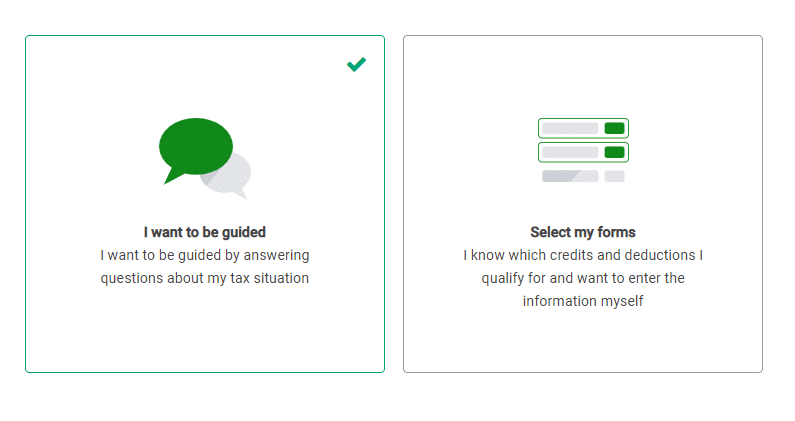

Choose between questions and menu selection

Does E-file.com Make Tax Filing Easy In 2026?

Warning: Investment results must be manually entered, a monotonous and error-prone process

E-file.com offers an excellent user experience for filers with simple tax returns. Claiming deductions and credits is relatively simple. Many users can quickly find relevant sections and enter information. The clutter-free screens make filing intuitive.

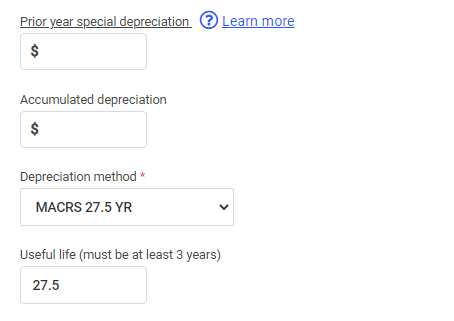

However, filers with investments or self-employment income are likely to find that e-file.com is less user-friendly. Our team of testers wondered whether they were entering information in the correct boxes. The depreciation “wizards” for real estate and business were quite confusing since they never showed the amount of depreciation claimed.

Stock or crypto traders would also be required to manually enter their trades via long-form screens rather than uploading spreadsheets or importing 1099 forms.

Example of unexpected complexity- Accumulated Depreciation is something that should be calculated.

E-file.com Notable Features

These are some of the features that set e-file.com apart from mid-priced alternatives.

Guided And Self-Guided Navigation Options

Users can choose guided or self-guided navigation on E-file.com. Filers who feel comfortable in one section (say Income) can opt for self-guided navigation in that section. Then they can resume a guided option (including questions and answers) for the deductions or credits sections.

Supports Multi-State Filing

Filers who earned income in multiple states can file in multiple states. E-file.com charges users on a per-state basis, so this isn’t a particularly great deal.

e-file.com Notable Drawbacks

E-file.com’s notable drawbacks make it less than the ideal product for most filers. These are some drawbacks potential users should understand.

Free Tier Requires Paying For State Filing

E-file.com’s free tier is incredibly restrictive. Filers with children, investments, HSA contributions, unemployment income, student loan interest deductions, and any other major tax situations must upgrade. But even worse, the Free tier isn’t actually free in practice. Filers have to pay $32.99 to file their state return.

No Section Summaries

Many tax programs show section summaries to help filers see their numbers. These help filers figure out whether they may have missed a source of income or an important deduction. E-file.com does not have these summaries, making filing more difficult, especially for filers with investments.

Confusing “Wizards”

E-file.com has a few calculators it calls “wizards”. These wizards, which can be used to calculate depletion, mileage deductions, or depreciation, were fairly confusing. They didn’t explain where a filer could find certain information, and a few contained unclear tax jargon.

Tech Support Requires Payment

Users who want tech support must upgrade to E-file.com’s Deluxe tier. This is tech support only and doesn’t include help filing taxes.

E-file.com Plans And Pricing

E-file.com pushes a surprising number of people to the “Premium” plan. The Free edition is highly restrictive, as was previously discussed.

The Deluxe tier only supports W-2 income, unemployment income, and a few deductions (including mortgage interest). It also supports the Child Tax Credit but is limited to households with income below $100,000. Filers with higher income, other sources of income, or other deductions or credits to claim must upgrade to premium.

As of this writing, coupon code FED15OFF gets you 15% off the federal filing price on the Deluxe and Premium Plus plans.

|

Free Edition |

Deluxe |

Premium |

|

|---|---|---|---|

|

Best For: |

W-2 Income, No dependents, income less than $100,000 |

Children (no dependent care credits), unemployment income, income less than $100,000 |

Everyone else (HSA, business income, all other deductions, etc.) |

|

Federal Cost: |

$0 |

$29.99 |

$49.99 |

|

State Cost: |

$32.99 per state |

$32.99 per state |

$32.99 per state |

|

Total: |

$32.99 |

$62.98 |

$82.98 |

How Does E-file.com Compare?

E-file.com has mid-market pricing, so we’ve compared it to low-cost competitors. Cash App Taxes offers the best overall user experience, but users may prefer FreeTaxUSA because it supports multi-state filing. We don’t anticipate filers ever finding a particular reason to use E-file.com over one of these less expensive alternatives.

|

Header

|

|

|

|

|---|---|---|---|

|

Rating |

|||

|

Stimulus Credit |

Free |

Free |

Free |

|

Unemployment Income (1099-G) |

Deluxe |

Free |

Free |

|

Student Loan Interest |

Premium |

Free |

Free |

|

Import Last Year’s Taxes |

Only from E-file.com |

Free |

Free |

|

Snap a Pic of W2 |

Not available |

Not available |

Not available |

|

Multiple States |

$32.99 per state |

$15.99 per state |

Not supported |

|

Multiple W2s |

Free |

Free |

Free |

|

Earned Income Tax Credit |

Free |

Free |

Free |

|

Child Tax Credit |

Deluxe |

Free |

Free |

|

Dependent Care Deductions |

Premium |

Free |

Free |

|

HSAs |

Premium |

Free |

Free |

|

Retirement Contributions |

Premium |

Free |

Free |

|

Retirement Income (SS, Pension, etc.) |

Premium |

Free |

Free |

|

Interest Income |

Premium |

Free |

Free |

|

Itemize |

Premium |

Free |

Free |

|

Dividend Income |

Premium |

Free |

Free |

|

Capital Gains |

Premium |

Free |

Free |

|

Rental Income |

Premium |

Free |

Free |

|

Self-Employment Income |

Premium |

Free |

Free |

|

Small Business Owner (Over $5k in Expenses) |

Premium |

Free |

Free |

|

Audit Support |

Premium |

Deluxe ($7.99) |

Free |

|

Support From Tax Pros |

Not Available |

Pro Support ($44.99) |

Not Available |

|

First Tier Pricing |

Free Edition $0 Fed & |

Free Edition $0 Fed & |

$0 Fed & $0 State |

|

Second Tier Pricing |

Deluxe $29.99 Fed & |

Deluxe $7.99 Fed & |

N/A |

|

Third Tier Pricing |

Premium $49.99 Fed & |

Pro Support $44.99 Fed & |

N/A |

|

Cell

|

Is It Safe And Secure?

E-file.com uses data encryption and multi-factor authentication to protect user information. This ensures that the site meets the IRS standards.E-file.com has never reported any major data breaches, so it seems likely that the company maintains high data security standards. However, no company can guarantee 100% data security. Users should carefully evaluate any tax software provider before deciding to use it.

How Do I Contact The E-file.com Support Team?

This is an area where E-file.com falls short. As mentioned previously, unless you upgrade to at least the “Deluxe” edition, you won’t even get access to basic phone and online support. Regardless of your plan, you won’t have the option to reach out to tax pros for advice.

Despite the lack of support, most customers on Trustpilot report positive experiences, and the company maintains an A+ rating with the Better Business Bureau (BBB). This is likely because e-file.com attracts filers who are comfortable handling their tax returns on their own. But if you’re looking for some hand-holding along the way, e-file.com won’t be the right tax software for you.

Why Should You Trust Us?

The College Investor team spent years reviewing the top tax filing options, and we have personal experience with most of the tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief, Robert Farrington, has been testing tax software tools since 2011 and has tried almost every tax filing product. If you prefer watching over reading, our team created reviews and video walk-throughs of the major tax preparation companies on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

How Was This Product Tested?

In our original tests, we used e-File.com to complete a real-life tax return that included W-2 income, self-employment income, rental property income, and investment income. We tried to enter all the data and use every available feature. We then compared the result to all the other products we’ve tested, as well as a tax return prepared by a tax professional.

This year, we went back through and re-checked all the features we originally tested, as well as any new features. We also validated the pricing options.

Who Is This For And Is It Worth It?

While E-file.com has a decent user interface, the product only works well for filers with relatively straightforward returns. Those with straightforward returns can find lower-cost alternatives that work equally well.

But if you have a somewhat complex return, you’ll probably want to opt for a more robust alternative. For 2026, we recommend that most filers skip e-file.com. Instead, choose the best tax software for your situation.

E-file.com FAQs

Here are the answers to a few of the most common questions that filers ask about E-file.com:

Can E-file.com help me file my crypto investments?

E-file.com supports crypto trades, but it requires filling out a detailed form for each trade throughout the year. Most traders won’t want to spend the time needed to do this. This year, a better alternative is TurboTax Premier.

Can E-file.com help me with state filing in multiple states?

Yes, E-file.com supports multi-state filing. Users must pay $32.99 per state.

Does E-file.com offer refund advance loans?

No, E-file.com does not offer refund advance loans in 2026.

The post E-file.com Review 2026 appeared first on The College Investor.