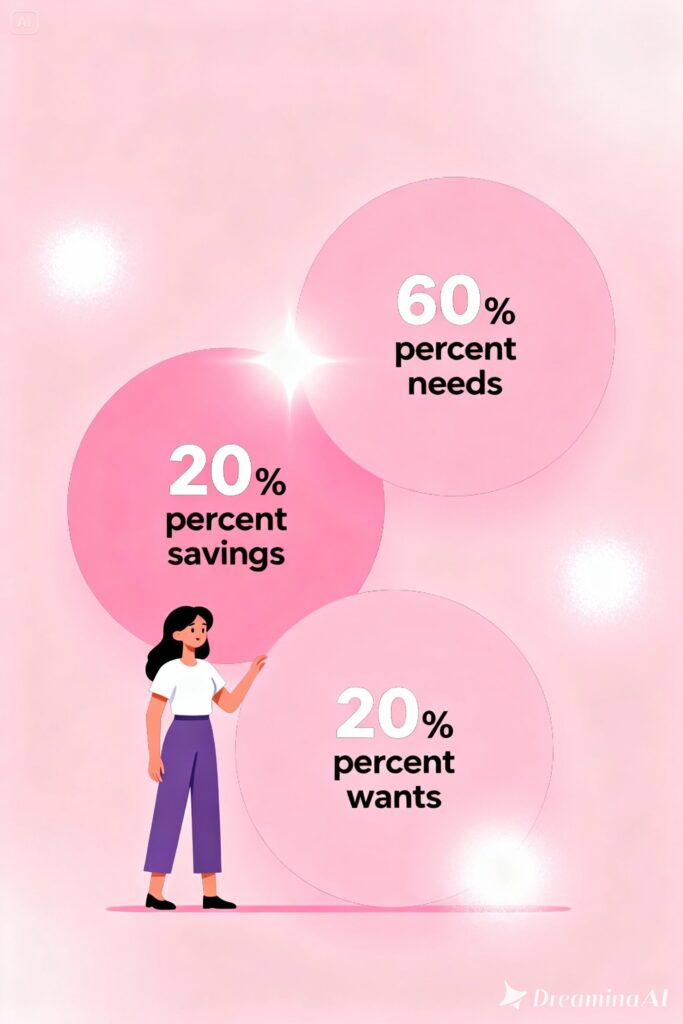

Budgeting doesn’t have to feel like a math problem or a constant struggle between what you need and what you want, it can be simple and straightforward, designed to meet your comfort and balance. The 60-20-20 rule is a simple budgeting method that helps you manage your money without feeling restricted or punished. This method focuses on assigning 60% of your income on your needs and basic expenses, 20% for savings or debt repayments, and lastly, 20% for personal spending or the non-essential expenses. This article will help you explore the dynamics of the 60-20-20 rule in detail, allowing you to manage your finances in a way that brings peace to your financial life.

Understanding the 60-20-20 Rule

The 60-20–20 rule divides your income into three simple categories, needs, savings or debt repayment, and personal spending. What makes this method a considerable option is that it is simple and flexible, demanding consistency and balance instead of perfection.

You can start by making sure your essentials or those basic expenses are covered, then move on to setting aside an amount for saving or paying off debt, if there is any, lastly, spend your income on things you enjoy such as coffee runs, snacks, or something you’ve been eyeing. This method makes it easy to stick with the expenses that are essential, makes room for your future, all while addressing your wants as well, offering a framework that perfectly balances all three.

Why This Budget Hack Works for Most People

The reason this method works the best for many people is that it prioritizes balance instead of perfection. Many people fail at budgeting or give in midway only because they view budgeting as something that involves cutting back on things they enjoy.

The 60-20-20 rule focuses on proportion, giving your savings and wants a portion of the income you work so hard for. Whether you’re trying to build an emergency fund, want to save up for a big future purchase, or simply want to manage money in an effective way, this method gives structure and discipline to your finances like none other, making it a considerable option.

Start by Calculating Your Total Monthly Income

Before you apply the 60-20-20 rule, you need to begin by calculating your exact monthly take-home income, the amount after all the taxes and deductions. Once you have an exact figure, you can divide it into proportions provided by the method, helping you plan your expenses surrounding that number. For example, if you earn $3,000 per month, according to the 60-20-20 rule, 60% of your income goes towards needs, $600 to savings or debt repayments, and lastly $600 to wants.

Seeing the exact spending amount for each category can help you plan your expenses and avoid emotional spending or overspending in a specific category.

The First 60%: Covering Your Needs and Essentials

Once you know the exact number for your first spending category, those basic and essential expenses that are necessary for survival, you can start planning for them. This category can include rent, housing, mortgage, utilities, food, or transportation.

If you find that essentials are taking up more than 60% of your income, that’s your hint to reassess your lifestyle choices such as moving to a more affordable place or cutting back on subscriptions you no longer use. You just need to find more intentional and mindful ways to bring your needs to fit the 60% spending limit, ensuring that you don’t constantly have to worry about your finances.

The First 20%: Prioritizing Savings and Debt Repayment

The next step is to assign 20% of your income to savings or debt repayment. This category is all about paying the future you,, whether it’s building an emergency fund, contributing to investments, or paying off student loans or credit cards.

If you want, you can even divide this section into two, 10% for savings and 10% for debt repayment. Even if you begin with setting aside a small amount, that is absolutely okay, because what matters the most is your consistency and your willingness to put something aside, contributing to the betterment of your future.

The Second 20%: Spending on Wants and Lifestyle

Once you’ve assigned a purpose to 80% of your income, the next step is to focus on the next 20% that goes to your wants and things that bring you pleasure and fun. Whether it’s a nice outing, a fun hangout with friends, or a fun trip you’ve been planning, the key is to balance wants with needs and savings.

This 20% is not about spending responsibly but about enjoying your money in a guilt-free manner, as long as it’s within limits and doesn’t put your entire progress off track. Giving yourself the space to spend on things you like can help you stick to the process no matter the ups and down, allowing you to follow the rule without feeling restricted or deprived.

Adjusting the Rule to Match Your Financial Reality

Once you’ve covered all your income, the next step is to consider the possibility of adjusting the rule to match your financial reality. Everyone’s financial situation is unique and that’s completely okay. If you feel like your needs cost more than 60%, you can modify the percentages accordingly by following a 70-15-15 version. Similarly, if you feel like you’re in a high-debt phase, you can consider the 50-30-20 version of the rule.

This method is all about giving you flexibility and room to make comfortable financial choices that bring you peace and a sense of calm.

How to Automate the 60-20-20 System

One of the easiest ways to stick to the 60-20-20 rule is by automating your finances. You can set up an automatic transfer from your checking account to your savings account right after your payday. What makes this a considerable hack is that it takes away the stress of remembering to transfer the amount while also taking away the effort of moving it manually.

Automation helps you rely less on willpower and more on consistency, helping you save in a low effort and low maintenance manner. Over time those small transfers can add up to something big and meaningful, making every deposit worth it.

Tracking Your Progress Without Stress

Tracking doesn’t always have to mean logging every penny or creating complex spreadsheets, it’s simply about staying aware of where your money is going every month. You can track your expenses using apps, notes, or something as simple as a journal that helps you see how closely you’re following the 60-20-20 framework.

This awareness can help you see patterns or identify those leaks where you’re more likely to spend your hard-earned money on, allowing you to make modifications to your spending habits and urging you to spend mindfully and intentionally.

Common Mistakes to Avoid

While the 60-20-20 rule is simple, there are a few common mistakes that can make it less effective if you’re not careful. One of the biggest ones is not being realistic about your expenses. Many people underestimate how much they actually spend on needs like groceries or transportation, which later leads to overspending in the essentials category.

Another common mistake is not treating savings as a priority. Often, people save only what’s left after spending, but the 60-20-20 rule encourages the opposite, to treat savings as a fixed expense that comes before wants.

Similarly, some people completely skip the “wants” section in the name of being productive, but that can backfire too. Giving yourself the freedom to spend on things you love, within reason, makes the process more joyful in the long run.

When to Reassess and Rebalance Your Budget

You should reassess your 60-20-20 budget every few months or whenever a major financial change occurs. For instance, if you get a raise, change jobs, move to a new city, or start paying off a big loan, those are signs that it’s time to rebalance your percentages.

Reassessing helps you make sure your budget still reflects your current lifestyle and goals. Maybe your rent increased and your “needs” category needs more room, or maybe you’ve paid off a big debt and can now save more.

Who Should Try the 60-20-20 Budget

The 60-20-20 budgeting method works best for people who want simplicity and structure without feeling restricted. If you’re someone who struggles to keep up with complicated budgeting spreadsheets or detailed tracking systems, this rule can bring calm and clarity to your financial life. It’s especially helpful for beginners who want a starting point that’s easy to follow and doesn’t require too many calculations.

This method is also great for people with a steady income who want to balance their responsibilities with their personal enjoyment.

Conclusion

The 60-20-20 rule is more than just a budgeting formula, it’s a lifestyle framework that teaches you how to live with balance and intention. It takes away the guilt of spending while giving structure to your saving habits, allowing you to enjoy your money without losing control of it. What makes this method truly effective is its simplicity, you don’t need to be a financial expert to follow it, just stay consistent and mindful about how you handle your income. Over time, these small intentional steps can turn into lasting habits that build a secure and joyful financial life.